Do You Have Tax Issues?

Our team of tax experts has assisted more than tens of thousands of taxpayers in resolving tax-related problems, including the reduction or complete elimination of their tax liabilities!

Settle Your Tax Issues from the Convenience of Your Home!

Complimentary Consultation 8AM - 6PM PST

Click To Call Us: (855) 930-1954

Resolve Your IRS Tax Problems

Answer The Survey To See If You're Eligible:

Reduce or Eliminate

Top Tax Problems Solved Through Tax Relief:

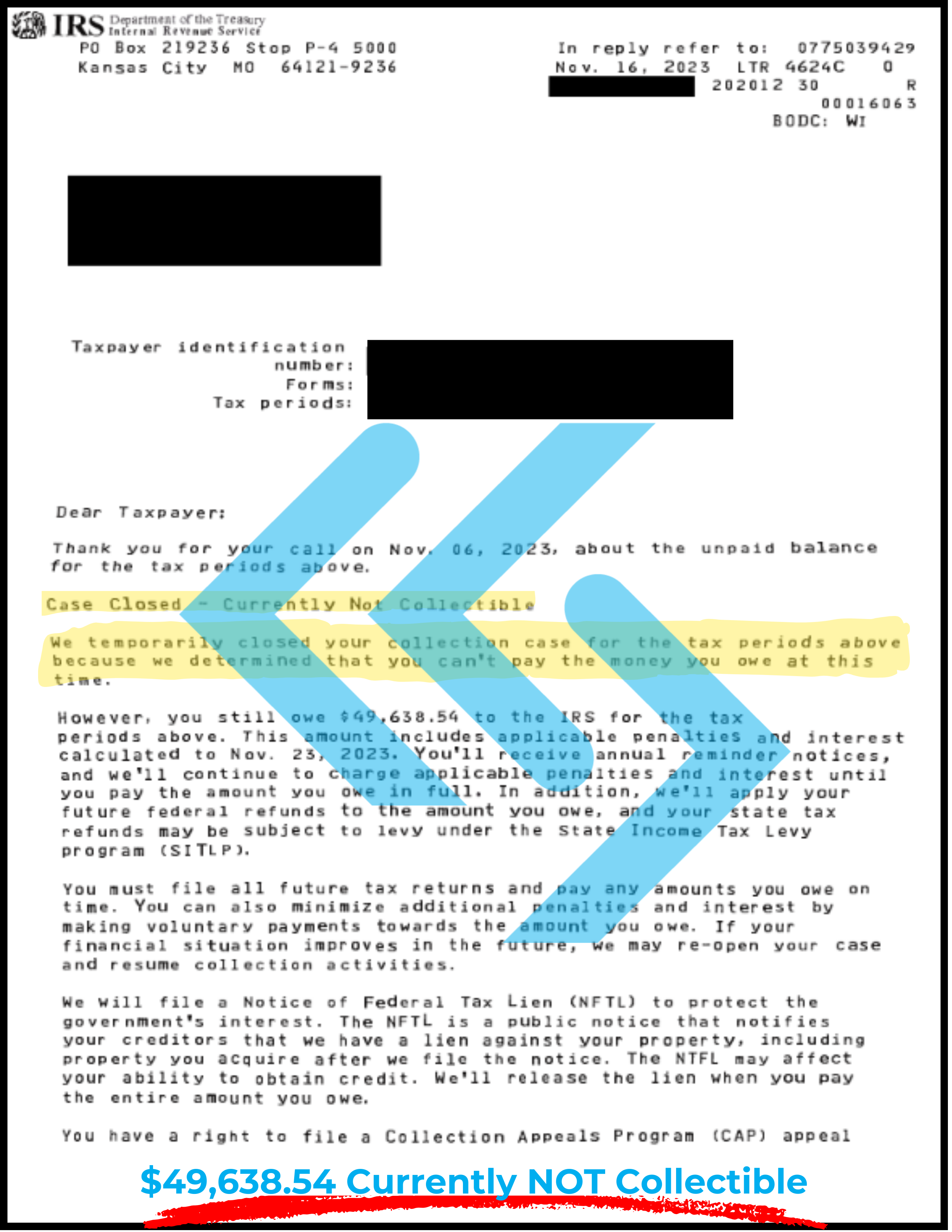

Unpaid Back Taxes

Whether due to unfiled tax years, failure to pay, or any other cause leading to the accumulation of back taxes, this issue is among the most prevalent faced by taxpayers.

Wage Garnishments

If the IRS is unable to receive payments directly from the taxpayer, they may take aim and garnish your wages.

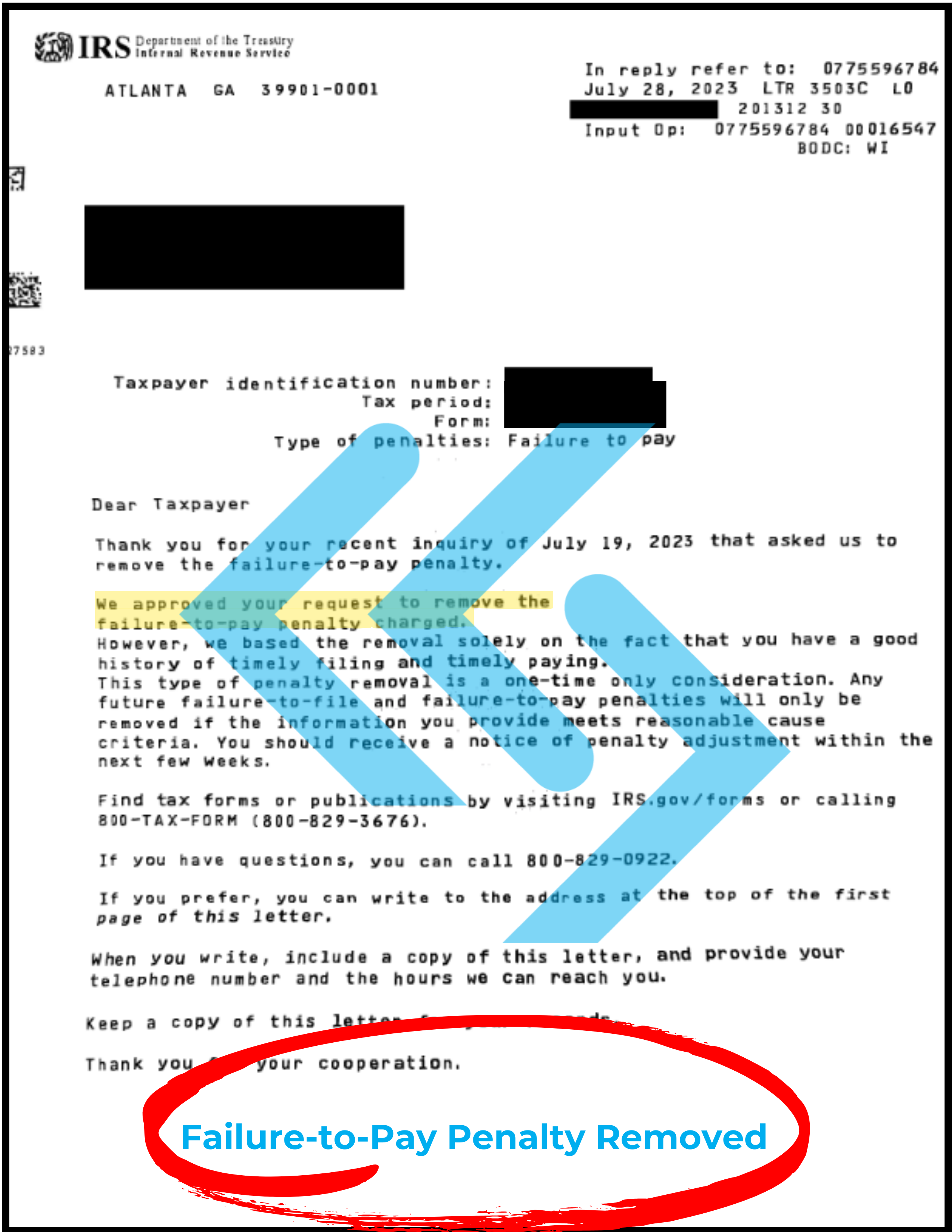

Tax Penalties & Fees

The more you delay settling your unpaid back taxes, the greater the interest and penalties that will accumulate.

IRS Audit

Facing the IRS directly is a highly risky step, particularly if you're doing it alone. Ensure greater security by seeking professional representation.

Tax Liens & Levies

Wage garnishments are not the only measure; the IRS also possesses the power to place liens on your property and even levy them to fulfill your outstanding tax liability.

Unfiled Tax Years

Even if you feel safe by not filing your taxes, you're still obligated to pay them. The IRS has the authority to file on your behalf, potentially resulting in a balance owed.

Asset Seizures

The IRS has the authority to seize a wide range of assets—including bank accounts, 401(k)s, real estate, and personal property—if you have unpaid taxes and haven't arranged a payment plan or settlement.

Resolving Taxes In Two Easy Steps

Step 1: Investigation

We begin our process with a complimentary consultation, followed by an in-depth investigation to determine precisely how much you owe to state and federal agencies, as well as uncovering any tax issues you might be unaware of. Then, we establish compliance with the IRS.

Step 2: Resolution

Clean Start Tax will then offer an optimal IRS resolution based on best-case practices. Utilizing our experience and expertise positions us to maximize your savings. We'll assist in determining and customizing a plan to achieve resolution.

10+ Years of Experience

2159+ Successful Cases

HowToGetTaxRelief.com operates as a comprehensive tax liability resolution firm, assisting taxpayers across the entire United States with virtually any IRS and state tax issue.

© Copyright 2025. HowToGetTaxRelief.com. All rights reserved.

This site is not a part of the Facebook website or Facebook, Inc. Additionally, this site is not endorsed by Facebook in any way. FACEBOOK is a trademark of FACEBOOK, Inc.

By submitting your phone number and email you are providing express written consent for HowToGetTaxRelief.com and its affiliates, agents, and service providers to contact you at that number regarding products or services, including via autodialed and/or prerecorded or artificial voice calls and text messages (SMS and MMS), or email even if your telephone number is a cellular number or on a corporate, state, or the National Do Not Call Registry (DNC) or other do not contact list. You may opt-out at any time by emailing us a Do Not Call Request. Your consent is not required or a condition of any purchase. Message and data rates may apply. You also consent to our SMS terms, Privacy Policy and Terms of Use. By communicating with us by phone or email, you give your full consent for any and all calls, texts and emails to be recorded for quality and training purposes.

This is not an offer to enter into an agreement. Not all customers will qualify. Information, eligibility, and programs are subject to change without notice. All products are subject to program approval. Other restrictions and limitations may apply. Restrictions apply.